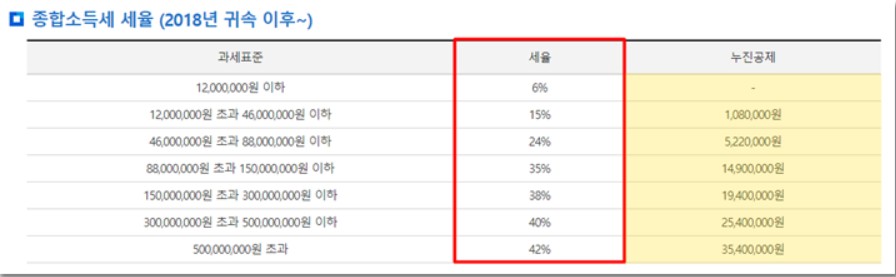

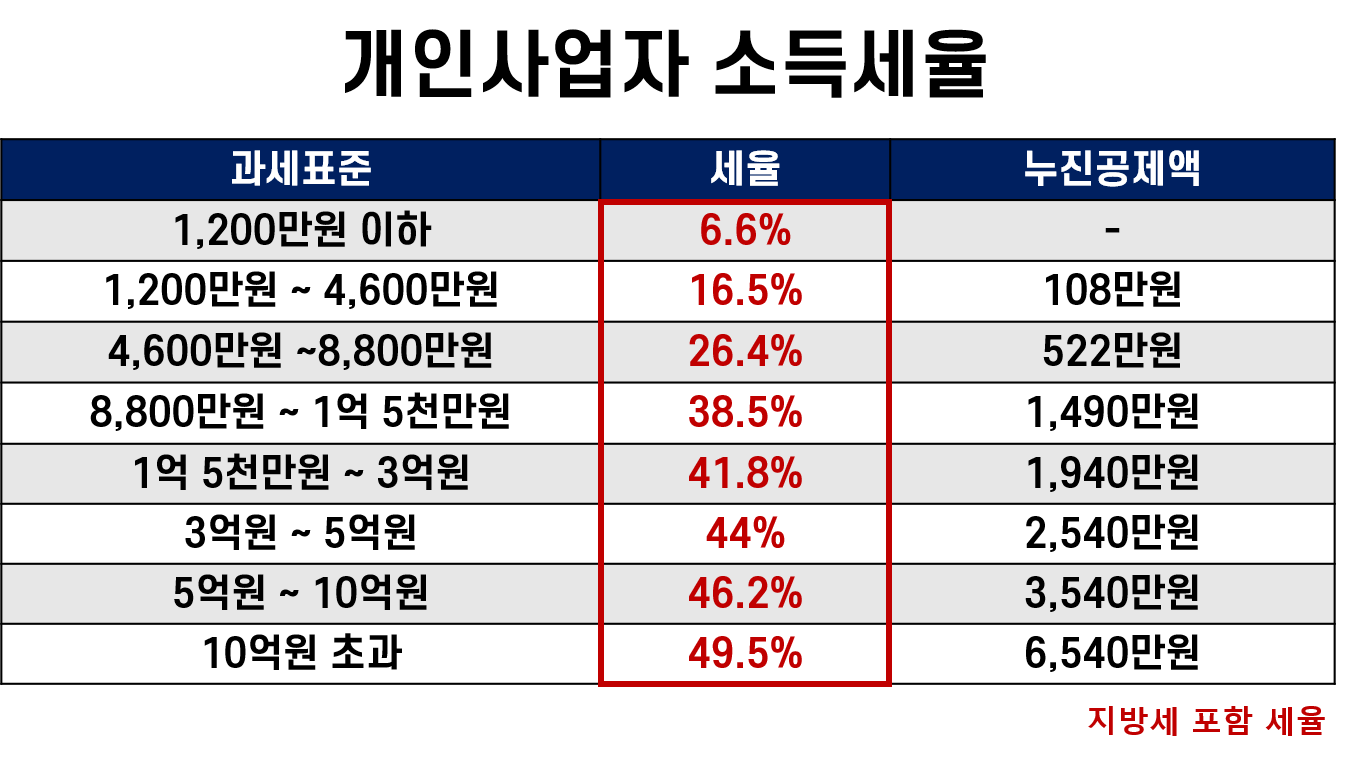

Since the comprehensive income tax for individual businesses is an essential obligation, it must be reported and paid in May. Businesses will have to make tax cuts and refund strategies when reporting comprehensive income taxes to achieve business cost savings in management and reduce the high tax burden so that they can live a stable life.There is a government-supported public system that receives the most refunds when reporting comprehensive income taxes for individual businesses. The system is a “yellow umbrella deduction” that provides income deduction benefits and allows effective tax reduction strategies to be established by receiving tax refunds when reporting comprehensive income taxes for individual businesses.The government-supported yellow umbrella deduction has the highest income tax reduction limit among the tax reduction systems. The tax reduction limit provided by income tax deductions is up to 5 million won per year. It is applied differently by tax base depending on business income, and the lower the income, the higher the limit can be measured. Yellow Umbrella Deductible Income Tax Reduction Example Table

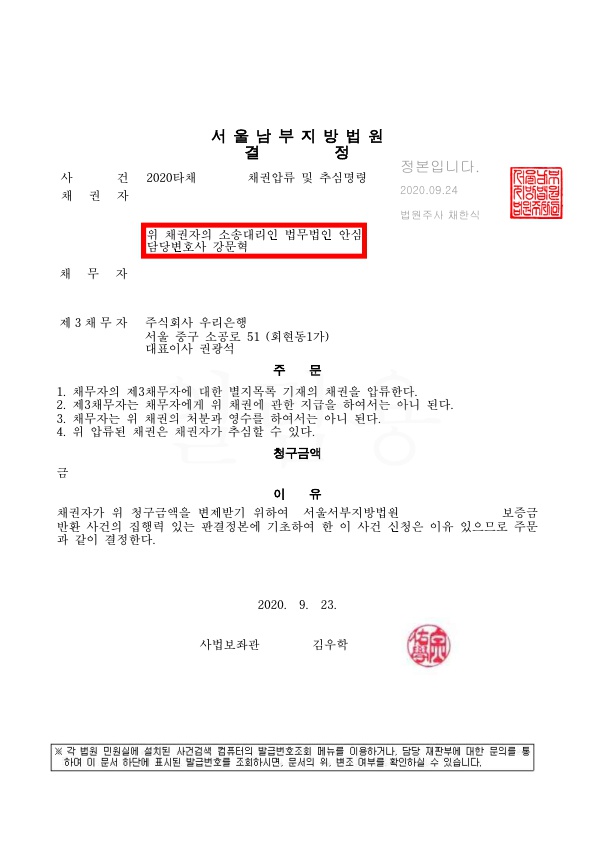

The yellow umbrella deduction income deduction benefit, which can be benefited when reporting comprehensive income tax for individual businesses, is applied to the installment amount paid by the business operator, and amounts exceeding the limit are excluded from income deductions. The yellow umbrella deduction income deduction benefit is automatically applied when reporting comprehensive income tax for individual businesses. Even businesses that have subscribed to the yellow umbrella deduction are excluded from income deductions that can benefit from reporting comprehensive income taxes for individual businesses. Real estate rental businesses and corporate businesses with a total salary of more than 70 million won are excluded from income deduction benefits and cannot receive tax savings in the event of comprehensive income tax for individual businesses.

Businesses that can subscribe to the government-supported yellow umbrella deduction can sign up if they correspond to small business owners by industry. In addition, freelancers who are paid after deducting 3.3% withholding can join. The yellow umbrella deduction, which is subscribed to for the purpose of raising large sums of money, is paid by the operator as a monthly or quarterly payment, and can be set in units of 10,000 won from 50,000 won to up to 1 million won. Various benefits are provided to subscribed operators. △ Income deduction benefits △ subscription incentives local governments support △ annual welfare interest of 3.3% △ full application of the Seizure Protection Act △ welfare plus & accident insurance subscription support △ operation financing within the payment amount are prepared.

Annual compound interest is added to the total amount of annual compound interest paid by the yellow umbrella deduction. The interest rate is applied at 3.3 percent and is provided at annual compound interest, so long-term subscribers are more advantageous in raising large amounts of money. The Yellow Umbrella Mutual Aid Hope Incentive is operated with the support of local governments and is a benefit provided only to new subscribers of Yellow Umbrella Mutual Aid. It provides monthly support of 10,000 won to 20,000 won per year. Since it is operated on the budget of local governments, if the budget is exhausted early, support may be limited. Yellow Umbrella Deduction Hope Encouragement Fund by Local Government

It provides high-quality welfare services free of charge and at discounted prices to businesses that subscribe to welfare plus benefits. Types include travel and cultural life, medical examinations, professional and management counseling, shopping malls, and free accident insurance for two years. The easiest way for business operators to sign up for the yellow umbrella deduction is to visit the deduction counselor. Counselors can be assigned through call center counseling, and they visit in person according to the representative’s schedule to help sign up.One “business registration certificate” is enough for the documents that operators need to prepare, so they can go through the quick and simple subscription process.

It provides high-quality welfare services free of charge and at discounted prices to businesses that subscribe to welfare plus benefits. Types include travel and cultural life, medical examinations, professional and management counseling, shopping malls, and free accident insurance for two years. The easiest way for business operators to sign up for the yellow umbrella deduction is to visit the deduction counselor. Counselors can be assigned through call center counseling, and they visit in person according to the representative’s schedule to help sign up.One “business registration certificate” is enough for the documents that operators need to prepare, so they can go through the quick and simple subscription process.

stable financing policy [mutual aid fund]

Mutual Aid Fund Details Check (click) The mutual aid fund is a public system designed to effectively raise funds for businesses using government policy funds. It is operated with the aim of allowing operators to use the mutual aid project fund to establish management stabilization and bankruptcy prevention measures. Subscribed businesses can pay installments to the mutual aid project fund by selecting 100,000 won to 3 million won per month in units of 100,000 won. The amount and government contributions will raise funds to ensure stable and effective financing. You can freely apply for funding at any time when the total number of times is more than four. The mutual aid fund can be used to raise funds at any time.The reason why it can be done frequently is that the burden of raising funds is being reduced.

Special Benefit Items for Reducing the Burden of Mutual Aid Business Funds Full exemption of interest expense for each repayment fee 100% repayment period can be extended up to 3 years. Limited amount measurement by mutual aid fund within 3-10 times the total amount provided by local government

How do you measure the limit amount?Depending on whether or not collateral is provided to the mutual aid project fund, it may be less than or equal to the limit. Because it is measured as a limit amount that is a multiple of the paid amount, the number to which the multiple is applied varies depending on the collateral amount used as a reference for multiples measurement.Information on the types and interest rates of funds for deduction projects up to 10 times the total amount paid when providing collateral up to 3 times the maximum amount paid when unsecured

.jpg?type=w800)

How do local governments provide subsidies?Separate support benefits from local governments, which can see the effect of a rate cut, provide interest support for interest rates of 1-2%P loans when raising funds. It is a benefit provided by local governments cooperating with the Korea Federation of Small and Medium Business, the main agency of the mutual aid project fund, and all operators can receive it if they belong to local governments. If local governments’ budgets are exhausted early, support may be limited. What is the interest added to the installment?Interest is being added until the maturity of the mutual aid project fund. An annual interest rate of 1.5% is applied when maturity arrives, and an annual interest rate of 1.7% is applied every three months when the installment amount is maintained even after maturity.

Businesses subscribed with the yellow umbrella deduction can apply for up to 20 million won in funding with yellow umbrella preferential loans. Interest rate cuts will also be applied each time. Any operator with a business registration certificate can join the mutual aid project fund, and all industries are eligible.Examples of industries include industrial machinery, cargo transportation, agricultural experience, overseas direct purchasing, solar power, building management, overseas direct purchasing, pharmaceutical wholesale/retail, food processing

How much should government policy support funds and small business mutual aid funds be used to sign up for the yellow umbrella deduction?The specialized system for receiving government policy support funds is “Small and Medium Enterprise Mutual Aid Fund… blog.naver.com

<Copyright ownerⓒ blog.naver.com/jha409 >Polygon: Naver Shopping Smart Store Polygon Shield develops, produces, and sells leisure household goods that can be enjoyed in cars such as car lodging and camping.smartstore.naver.comLimujiii https://soundcloud.com/limujiiCreative Commons – Attribution 3.0 Unported – CCBY 3.0 Free Download / Stream : Audio Library https://youtu.be/cUWU_T9KBk8 によってプロモートされている https://bit.ly/39PgR3aMusic —-––––– – –——— By Limujii Commons — By Audio Library CCBY 3.0 Free Download / Stream: by (free download/stream)

:max_bytes(150000):strip_icc()/dotdash-ife-insurance-vs-ira-retirement-saving-Final-464e7c3711bb488d880a37c09bc0c55d.jpg)